Merchant Risk Solutions

Transaction Laundering Detection

LegitScript’s expert analysis and big data help you identify and stop transaction laundering fraud to reduce your risk and avoid card network fines.

LegitScript Is the Leader in Transaction Laundering Detection

Why do the world’s leading banks, payment facilitators, and ISOs trust LegitScript for transaction laundering detection? We root out these fraudsters with a unique combination of advanced technology, historical data, and human insight.

Big Data

LegitScript has one of the world’s largest databases of fraud networks comprising millions of websites and billions of data points.

AI-enhanced Technology

LegitScript’s technology scans and analyzes merchant websites for risk indicators of transaction laundering.

Human Insight

Our team of investigators goes beyond a merchant website, researching across the internet to identify illicit merchant activity.

Why Choose LegitScript Transaction Laundering Detection?

Our solution saves you hours of investigative work and enables you to action flagged merchants quickly and confidently.

No Add-on Costs

Our Transaction Laundering Detection solution isn’t an upcharge. We include it standard with our Merchant Monitoring solution.

Unparalleled Expertise

LegitScript uses two decades of merchant data combined with transaction laundering detection experts to research suspicious activity and confirm fraud so that you don’t have to.

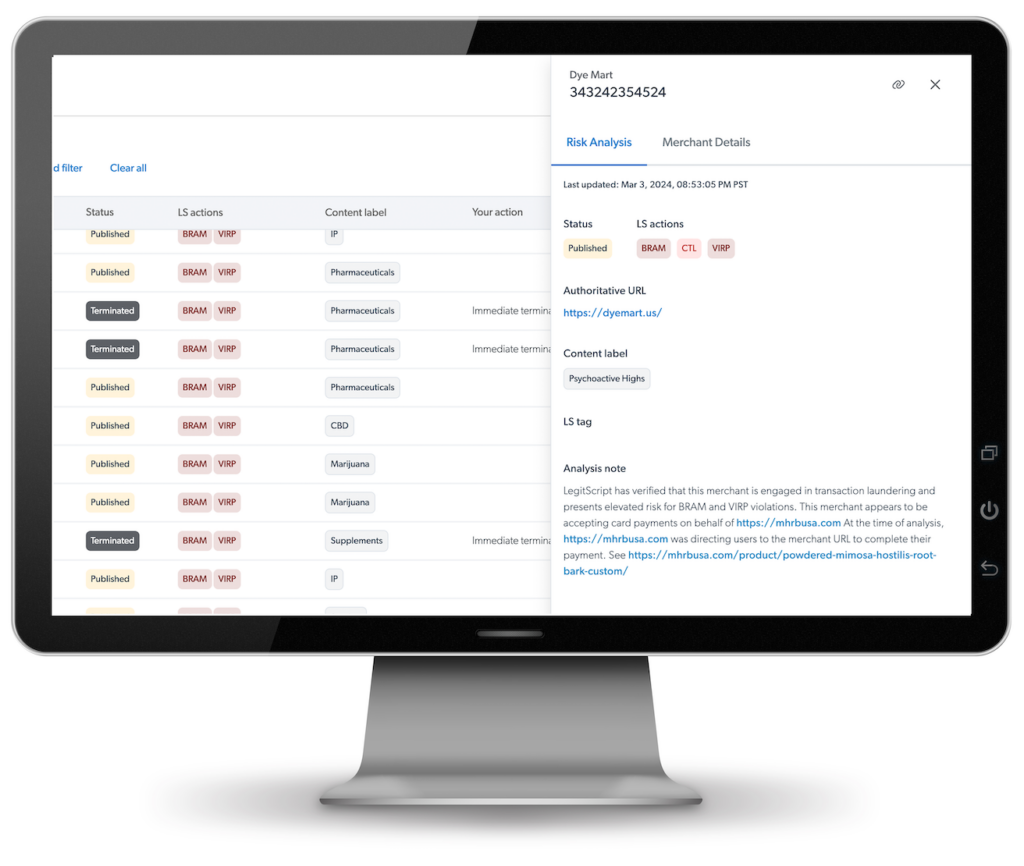

Confirmed Transaction Laundering

We don’t just report suspected transaction laundering. We differentiate between suspected and confirmed transaction launderers in a format that is easy to prioritize and action.

LegitScript uses nearly two decades of historical merchant data combined with transaction laundering detection experts to research suspicious activity and confirm fraud so that you don’t have to. You save hours of investigative work and can action flagged merchants quickly and confidently.

"LegitScript identified and confirmed transaction laundering activity before the card network. It's always great to show our bank and the card network that we were proactive."

- VP of Risk Management for a leading payment provider

Get Expert Guidance Tailored to Your Needs

Do you have questions or need assistance? Our team of experts are here to help. Fill out the form below, and a member of our solutions team will reach out to schedule time with you.

Discover More